Real Estate

Sep 17, 2024

Understanding Mortgage Rates and How They Impact You in 2024

When you're thinking about buying a home, one of the most crucial aspects to consider is the mortgage rate. Mortgage rates directly affect how much you’ll pay for your home over time. In 2024, these rates continue to fluctuate in response to economic trends, inflation, and market dynamics, making it essential for prospective homeowners to understand their implications.

In this blog, we'll break down what mortgage rates are, the factors that influence them, and how they can impact you financially in 2024.

What Are Mortgage Rates?

A mortgage rate is the interest rate charged by lenders when you borrow money to purchase a home. This rate is a percentage of the loan amount, and it dictates the cost of borrowing that money. The higher the mortgage rate, the more you'll pay in interest over the life of the loan.

Types of Mortgage Rates

In general, mortgage rates come in two primary types:

1. Fixed-Rate Mortgages

A fixed-rate mortgage offers an interest rate that remains constant for the life of the loan, typically 15, 20, or 30 years. Fixed-rate mortgages are appealing to buyers looking for stable, predictable payments.

2. Adjustable-Rate Mortgages (ARMs)

With ARMs, the interest rate changes after an initial fixed period, which could be 5, 7, or 10 years. After this period, the rate adjusts annually based on market conditions. ARMs typically offer lower initial rates but can become risky when rates rise after the adjustment period.

“The home sale data on this page is based on analysis. Adding these design features to a home does not guarantee or definitively cause the ultimate sale price to increase as much as observed”.

How Are Mortgage Rates Set?

Mortgage rates are influenced by a combination of economic factors and your individual profile as a borrower. Here’s how these two main categories break down:

1. Economic Factors

- The Federal Reserve (Fed): The Fed doesn't directly set mortgage rates, but its decisions on federal interest rates impact them. When the Fed raises or lowers interest rates to combat inflation or stimulate the economy, mortgage rates often follow suit.

- Inflation: The Fed doesn't directly set mortgage rates, but its decisions on federal interest rates impact them. When the Fed raises or lowers interest rates to combat inflation or stimulate the economy, mortgage rates often follow suit.

- Bond Market: The Fed doesn't directly set mortgage rates, but its decisions on federal interest rates impact them. When the Fed raises or lowers interest rates to combat inflation or stimulate the economy, mortgage rates often follow suit.

2. Borrower-Specific Factors

- Credit Score: Lenders evaluate your credit score to assess your risk as a borrower. Higher credit scores usually lead to lower mortgage rates, while lower scores may result in higher rates.

- Loan Amount and Down Payment: The size of your loan and the percentage you can pay upfront as a down payment also influence your rate. Larger down payments often result in lower rates since they reduce the lender’s risk.

Mortgage Rate Trends in 2024

In 2024, mortgage rates are expected to fluctuate due to several key economic factors:

- Interest Rate Hikes by the Fed: As inflation remains a concern, the Fed has hinted at continued rate hikes. If inflation persists, mortgage rates will likely rise, increasing the cost of borrowing for homebuyers

- Market Volatility: Uncertainty in the global economy, geopolitical tensions, and market volatility can push investors towards safe-haven assets like bonds, impacting mortgage rates.

- Housing Market Demand: The demand for homes in 2024 may moderate compared to the pandemic-fueled years. This could result in a cooling of home prices, but higher mortgage rates may still challenge affordability for many buyers.

How Mortgage Rates Affect Your Monthly Payments

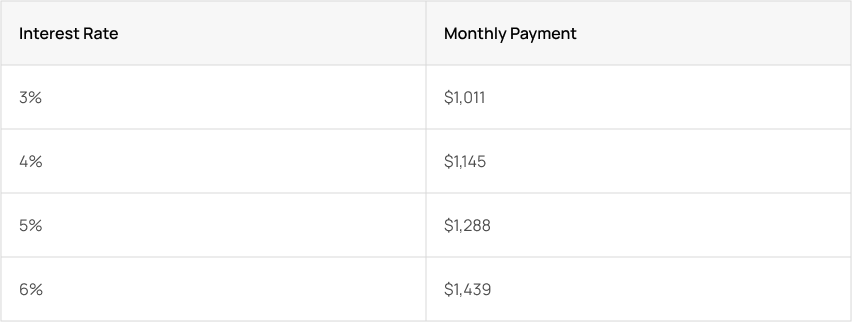

Let’s say you're buying a $300,000 home with a 20% down payment ($60,000) and taking out a $240,000 mortgage. If the interest rate is 3%, your monthly payment (excluding taxes and insurance) would be approximately $1,011. However, if the rate is 6%, your payment would jump to about $1,439.

This difference of $428 per month can add up quickly over the course of a 30-year loan.

Types of Mortgage Rates

In general, mortgage rates come in two primary types:

1. Improve Your Credit Score: Some lenders offer the option to "buy down" your rate by paying points upfront. This could save you thousands in interest over the life of the loan, but it requires a larger cash payment at closing

2. Shop Around: Some lenders offer the option to "buy down" your rate by paying points upfront. This could save you thousands in interest over the life of the loan, but it requires a larger cash payment at closing

3. Increase Your Down Payment: Some lenders offer the option to "buy down" your rate by paying points upfront. This could save you thousands in interest over the life of the loan, but it requires a larger cash payment at closing

4. Consider Points: Some lenders offer the option to "buy down" your rate by paying points upfront. This could save you thousands in interest over the life of the loan, but it requires a larger cash payment at closing

Final Thoughts

Understanding mortgage rates and how they affect you in 2024 is crucial for making informed decisions. With rates expected to fluctuate due to inflation, interest rate hikes, and market volatility, staying informed and being proactive is key. By improving your credit score, shopping around for the best rates, and considering the right mortgage type, you can save significant amounts over the life of your loan.

Table of Contents

More Articles

Top Tips for First-Time Homebuyers Sep 17, 2024

How to Stage Your Home for a Quick Sale Sep 17, 2024